Obligation to make additional payments: When traders have to pay (more than) their dues

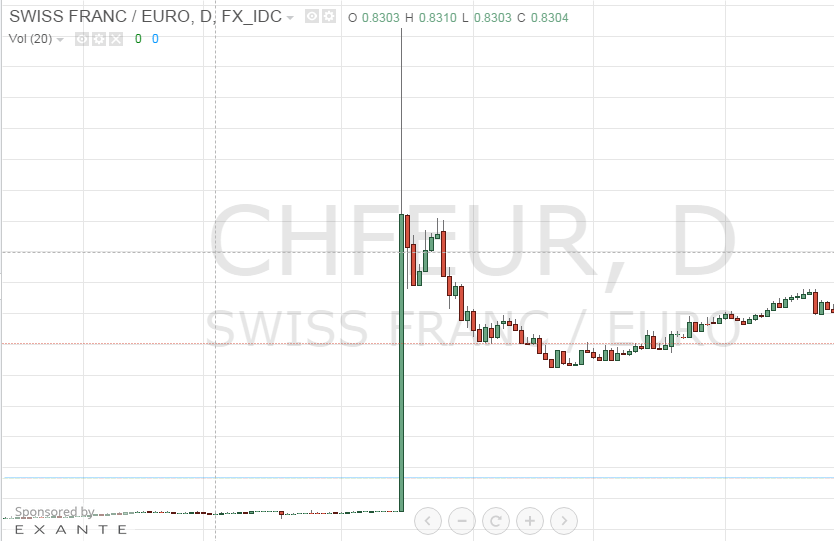

![]() It's an extreme scenario, but certainly within the realm of possibility: If the market moves too strongly against traders, more than 100% of the equity in a leveraged position can be used up and the account balance can become negative. Obligations to make additional contributions are not without danger – this was recently made clear by the “franc shock” in January.

It's an extreme scenario, but certainly within the realm of possibility: If the market moves too strongly against traders, more than 100% of the equity in a leveraged position can be used up and the account balance can become negative. Obligations to make additional contributions are not without danger – this was recently made clear by the “franc shock” in January.

Jetzt zu admirals CFD Service - 74% verlieren Geld

Facts about the obligation to make additional payments

- The obligation to make additional payments arises if the account balance is negative

- Under normal market conditions, “critical” positions are closed

- Close-out levels do not protect against price gaps and market turbulence

- Brokers can legally exclude any additional payment obligations

- Guaranteed stop-loss orders protect against price gaps

Marginal payments are claims made by a broker against its customers

![]() From a technical point of view, in FX or CFD trading there are always additional obligations to the detriment of traders. Each broker sets an initial margin required to open a position and a maintenance margin required to maintain the position.

From a technical point of view, in FX or CFD trading there are always additional obligations to the detriment of traders. Each broker sets an initial margin required to open a position and a maintenance margin required to maintain the position.

If a position develops unfavorably and the maintenance margin falls below the specified value, a form of additional payment obligation already exists: In this case, brokers grant themselves the right to close positions immediately if the customer does not immediately provide additional funds.

The latter usually happens silently and unspectacularly through the automatic transfer of account balances from the item “Freely available capital” in favor of “Bound margin”: As long as there is enough credit in the account, it is automatically used to maintain the position and can no longer be paid out be requested.

Jetzt zu admirals CFD Service - 74% verlieren Geld

Additional payment obligations are problematic when the account balance is negative

![]() Additional payment obligations are more problematic in connection with a negative account balance: If all of the equity in the trading account has been used up and all positions are closed due to the margin requirements not being met, the broker has a claim against its customer.

Additional payment obligations are more problematic in connection with a negative account balance: If all of the equity in the trading account has been used up and all positions are closed due to the margin requirements not being met, the broker has a claim against its customer.

When you open an account with a CFD/FX broker (most Forex brokers allow currency pairs to be traded under the legal umbrella of a CFD), you conclude a framework agreement for settlement of differences. This essentially stipulates that a contract for the settlement of differences is concluded between you and the broker when you place a corresponding order via the trading platform.

In principle, nothing changes just because your trading account no longer has any credit – the broker will then ask you to make additional capital contributions in response to his claim – possibly even through legal action.

Practical example:

Price gaps in particular lead to additional funding requirements

The biggest risk for traders with regard to an obligation to make additional contributions is price gaps, so-called gaps.

![]() But how can it happen that the capital in the trading account not only suffers a total loss (100%), but also that losses even exceed the total stake? Such an extreme trend in the account can only be expected if the market development is equally extreme. The greatest risk for traders with regard to the obligation to make additional payments is price gaps. This will be explained using a hypothetical example that, for reasons of simplicity, does not include spreads and commissions.

But how can it happen that the capital in the trading account not only suffers a total loss (100%), but also that losses even exceed the total stake? Such an extreme trend in the account can only be expected if the market development is equally extreme. The greatest risk for traders with regard to the obligation to make additional payments is price gaps. This will be explained using a hypothetical example that, for reasons of simplicity, does not include spreads and commissions.

There is €10,000 in a trading account. The account holder opens a long position in a CFD on the German stock index (DAX) in the amount of 100 contracts of €10,000 each, so that the total volume of the order is €1.0 million. The order is protected against price losses with a stop loss at 9950 points.

On the same trading day, a completely unexpected and very negative event occurs. The DAX falls sharply in less than a minute as a large number of sell orders enter the market and there are no buyers. Due to the market situation, the broker only managed to execute the stop loss order after several minutes – at the next best price of 9,750 points. This results in a loss of €25,000, which is offset by only €10,000 in equity. The broker demands that the negative balance of €15,000 be offset.

Jetzt zu admirals CFD Service - 74% verlieren Geld

Swiss National BankCloseout levels and stop losses do not always protect

![]() At the beginning of 2015, a real extreme scenario occurred that forced many traders to make additional contributions: the Swiss central bank SNB unexpectedly lifted the Swiss franc peg overnight and by the majority of market participants, whereupon the CHF appreciated sharply and even some brokers became insolvent.

At the beginning of 2015, a real extreme scenario occurred that forced many traders to make additional contributions: the Swiss central bank SNB unexpectedly lifted the Swiss franc peg overnight and by the majority of market participants, whereupon the CHF appreciated sharply and even some brokers became insolvent.

The example makes it clear that stop-loss orders do not provide absolute protection in extreme market conditions because their execution is market dependent. The same applies to close-out levels: Brokers use this to define margin scenarios that, when they occur, positions are automatically closed out in order to avoid a negative account balance.

For brokers, additional payment obligations are part of the calculation

For brokers, margin requirements are initially a logical conclusion to the calculation of settlement contracts. If you lose a lot of money with a long position, another customer of the same broker may make the same amount of profits with an opposite position. The broker is obliged to compensate this customer for the difference. If the broker waives the obligation to make additional payments to you, the other customer's profit would have to be financed from other sources – for example through generally wider spreads or additional fees.

Legally binding exclusion of the obligation to make additional payments – and the price for it

![]() Some brokers actually waive margin calls at the expense of their customers. If you are specifically looking for such a broker, you should definitely pay attention to the details in the small print of the contract conditions.

Some brokers actually waive margin calls at the expense of their customers. If you are specifically looking for such a broker, you should definitely pay attention to the details in the small print of the contract conditions.

Statements of this type are not very reliable because they are legally invalid in case of doubt: “Technical devices (close-out) exclude negative account balances”. Ultimately, this is information of little value, as every broker uses such systems in margin trading. However, these do not protect against additional payment obligations as a result of price gaps and other extreme market events.

If a broker bindingly excludes these, this is accompanied by higher margin requirements and thus lower leverage. The reason for additional payment obligations is often very large financial leverage in the range of 100:1 and greater. For accounts without margin calls, the maximum financial leverage is often capped at 50:1 or lower.

Jetzt zu admirals CFD Service - 74% verlieren Geld

CFD and Forex brokers with no additional payment requirement

FXCM (UK) announced in March that it would waive the first €50,000 of this for customers with negative account balances and would insist on the repayment of portions of claims exceeding €50,000.

comdirect offers CFD trading via various account models, including one with a binding exclusion of the obligation to make additional payments with margin requirements increased to 20%. Consorsbank has also now dispensed with additional payment requirements, and the British broker CityIndex offers accounts with mandatory placement of guaranteed SL orders, e.g. B. IG Markets also allows for part of the underlying catalog – just like CityIndex for additional fees.

Image source:

- shutterstock.com

- 0 EUR Mindesteinzahlung

- EUR/USD-Spread ab 0,3 Pips (ohne Kommission)

- 0 EUR im Aktien- und ETF-Handel